In a Radio 1 “What’s my age again?” game kind of fashion, you can probably guess someone’s age by asking them how they paid for their morning paper. Actually, the morning paper probably suggests they’re 60+ if it’s not an app on their phone! It’s fair to assume that no one reading this has ever traded cattle. At Placing Faces, our team sits in the middle, using a mixture of cash (rarely), card and contactless (predominantly). Please don’t ask us if we’ve got change for a tenner for the car park though (the app doesn’t give change).

Recently, we were asked to pay for a meal using a card and a “clacker”, because the card machine wasn’t working. Now, firstly, it’s a good job we had a card, because typically we would only have had our phone to pay contactless! This got us all talking because none of us had ever used one of these before! So we did a bit of Googling about the history of payments, and were really interested in the evolution of payments over the years. We narrowed it down to the main types of payments, the 5 C’s of transactions…

Cattle

Although the history of physical money dates back 3,000 years, transactions have been taking place much longer. A system of bartering was used. You would barter goods you had a surplus of, for things you needed. Popular goods to be traded for payment included cattle, grains, leather, and other commodities. The trouble with the barter system was that there was no common measure of value for the items involved. People would just conjure up their price. This also meant that business deals would often take time. Despite that, the barter system by way of payment still survives in many countries around the world today. Countries that aren’t cash-rich will still often trade commodities or livestock as payment. Western countries still use a form of bartering when we “do a favour” for someone; this is obviously just for informal deals, and not business transactions! How many chickens would you give us to find you a candidate for that job?

Cash: Coins and Notes

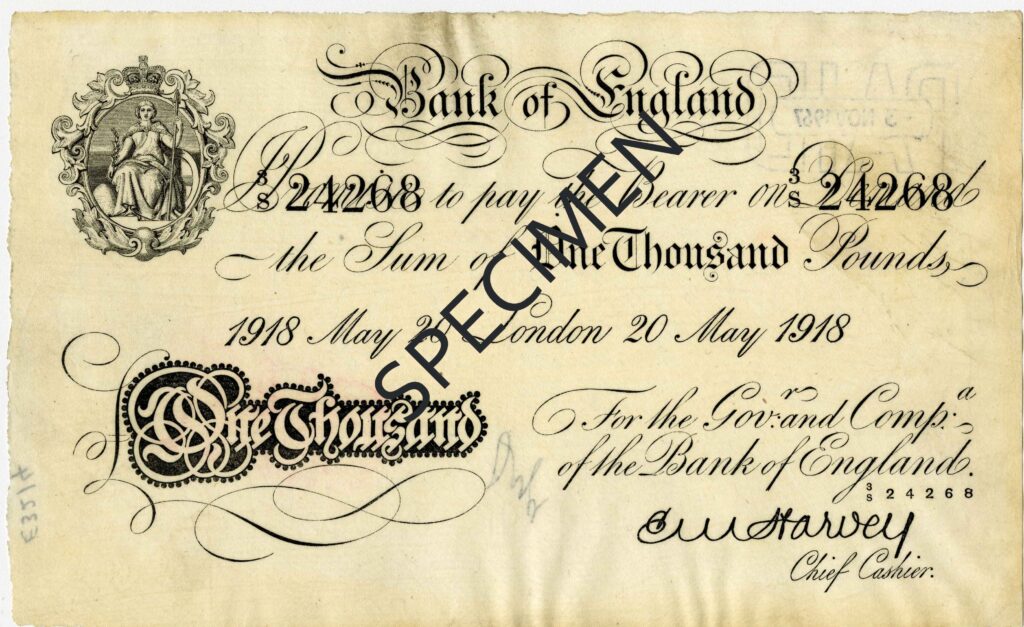

In ancient times, coinage was typically beads or shells, before precious metals like silver and gold. Bank notes were made of leather. Eventually, the Chinese developed paper money but its use wasn’t very standardised and dipped in and out. By the 16th Century, a lot of currency was typically gold. In 1694, a group of London merchants lent money in the form of “bank notes” to King William II to pursue a war in France. In exchange, they were allowed to call themselves the “Bank of England”. These notes were handwritten and signed by the chief cashier, John Kendrick.

FUN FACT:

Today, all bank notes still have the signature of the Bank of England’s Chief Cashier, Sarah John, who has been Chief Cashier since 2018. Thankfully, she doesn’t have to sign each one individually like poor John Kendrick did!

After 1696, it was decided not to issue notes less than £50, and since this was more than the average annual income, most went through life without ever using a banknote.

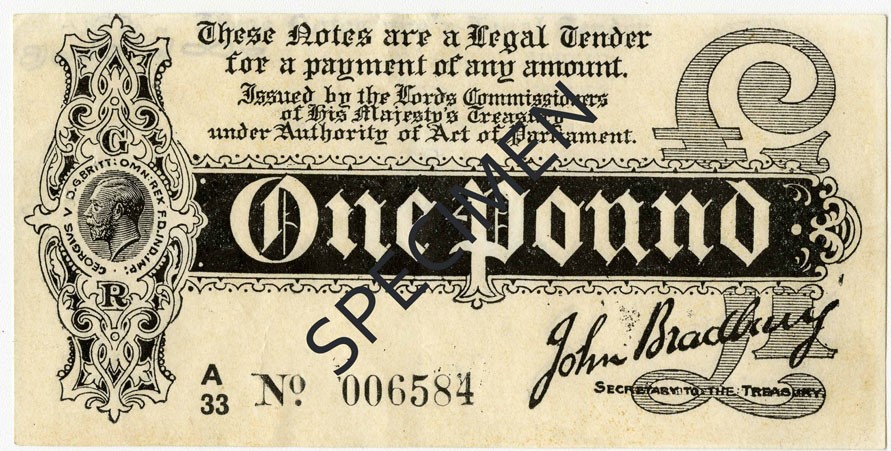

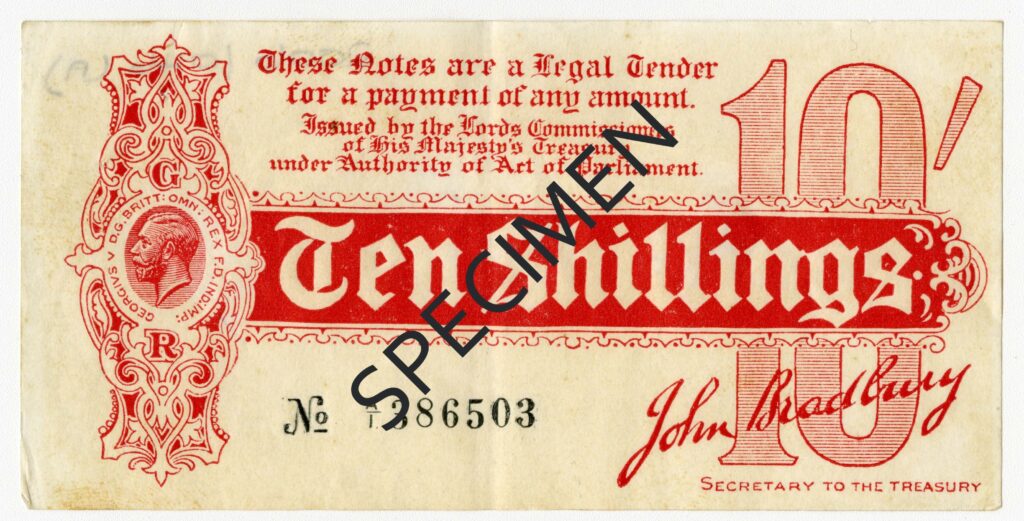

The first banknotes included £1000, £500, and £300 values (as well as smaller). These were issued by the Bank of England between 1725-1745 and were considered legal tender until 1945, although probably not in circulation for this long! There were many design changes between those years as there are now. The first note we may recognise is probably the £1 note, which was in circulation until 1988! We remember our parents having kept one to show us!

Every few years, the design of a banknote will change. This could be a change of the “great Briton” that they feature (previously figures like Charles Dickens, Sir Isaac Newton, Winston Churchill, Florence Nightingale and Charles Darwin). It could be a change of Chief Cashier. Even a complete revamp to protect against counterfeit, as it was when notes recently moved from paper to plastic. It could be a change of monarch; with the very recent death of HM Queen Elizabeth II (8th September 2022), all coins and notes will now be produced with the portrait of the new King Charles III. No additional changes to these notes will be made, and they are expected to enter circulation by mid-2024.

Cheque

Cheques evolved from letters written to goldsmith bankers, allowing customers to make payments without withdrawing money themselves. As banking became more organised, bankers began to print cheques ready for customers to fill in details by hand. One of the earliest cheques found in banking archives is from 1660. In the mid-17th Century early bankers wanted to make payment processes easier and less risky. They developed a way for customers to make payments using paper instructions, leaving their gold and silver safely tucked up in the vaults.

The cheque was at its peak in the 1990s. Now, they are almost obsolete. According to the Financial Times, cheques now account for less than 1% of retail payments, totaling 185m transactions last year, compared with 272m in 2019. Despite the skepticism, cheques are still a secure way of paying someone. Cheque fraud totalled just £12.3m in 2020, on 185m transactions. Online authorised payment scams totalled £479m last year, in 4.1bn online payments. Many businesses stopped accepting cheques as payment. This was down to a combination of cheques “bouncing” if the funds weren’t available; the length of time it took for the funds to become available, and the fees charged by the banks for processing. Today, it’s more likely that cheques are used to return money to us; you might receive a cheque from HMRC if you’re owed a tax rebate. Friends and family might send you a cheque in the post. In this instance, a cheque is safer; it cannot be cashed in by anyone other than the name on the cheque. You can now cash them in using apps on phones, rather than having to go down to a branch and wait 3-5 working days !

Cards: Credit and Chip & Pin

The first obvious precursors of the credit card as we know it were seen in the US before the UK. The ‘Charga-Plate’ was produced around 1935 and looked similar to military dog tags. It was embossed with your name, city and state, and held a small piece of paper for a signature. They were similar to department store cards, rather than credit cards, and were usually held by the store for their most regular customers. The plate would be retrieved from the store’s back offices when you wanted to make a purchase.

Credit

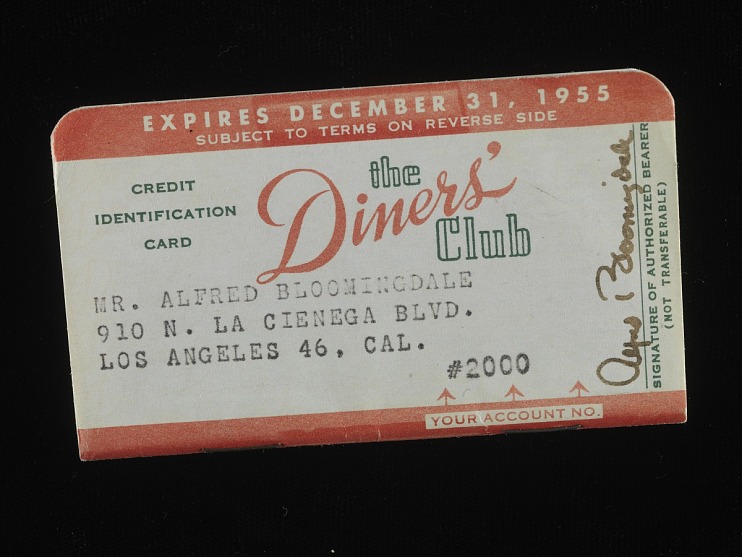

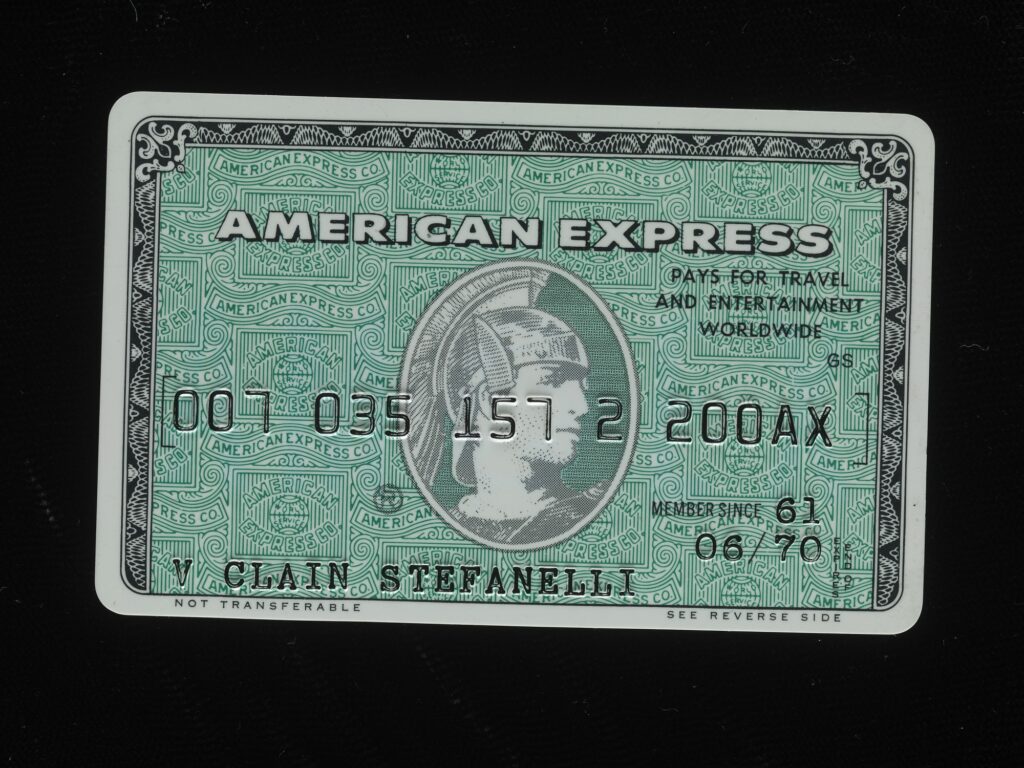

Along came the first “credit card” as we understand them today, from the Diners Club, which is still an international bank today. They got their name because old Frank forgot cash to pay for his meal in a restaurant and was highly embarrassed that his wife had to pay for him. He had the idea that you just used the card for transactions and then paid the balance at the end of the month. The idea appeared to be revolutionary and American Express was founded shortly afterwards, in 1958. In the same year, Visa was also founded but was known as BankAmericard from the Bank of America. Both American Express and BankAmericard were the first to work on revolving credit, where the balance would be carried over to the next month for a fee, similar to today’s credit cards.

These credit systems were brought to the UK in the 60s, with American Express first being used here in 1963. Barclay’s followed in BankAmericard’s footsteps and issued the first credit card in 1966. Interestingly, credit cards were around before debit cards; debit cards weren’t released until 1987, with Barclays being the first and naming it the Visa Delta.

Card payments

American Express created the first plastic card in 1959 which was embossed with a name, address and ID number. Merchants would produce an imprint of the card on carbon paper from an “imprinter” or “clacker”, named because of the noise it made when pressed down. The carbon paper slips would be signed by the customer; one would be kept by the customer, one kept by the merchant, and one sent to the bank to get the payment. This is the machine that we recently had to use when the card terminals were down! Today, many banks are making the change from embossing the front of their cards, to printing the details on the back, in an attempt to stop fraud and cloning, particularly at ATM machines.

In the 1970s, the magnetic stripe was added to payment cards and electronic card terminals were invented to read these. This made card payments much quicker, more accurate and more secure. The balance would now be pending to come out the account almost instantly, or would be refused on the spot if the balance wasn’t there, rather than waiting for slips of paper to be processed! Despite it being electronic, a signature was still needed for security. We can remember parents and grandparents having to swipe their card down the machine to pay for something!

Chip & Pin

In 1975, the “chip” was invented by Roland Moreno and was widely used on bank cards by 1985. These chips were mandatory on all cards in France from 1992, but weren’t introduced to the UK until 2004! A signature was still needed until the four-digit PIN system was introduced in 2006. Despite the US being the forerunner with credit cards, the chip and pin system didn’t reach them until 2015!

Contactless

In the grand scheme of the history and evolution of payments, contactless cards were a minor development compared to the invention of the chip and pin. The technology behind contactless is called Near-Field Communication (NFC), which uses radio-frequency identification (RFID) technology. NFC allows information to be transmitted in the vicinity of 10 cm.

In the UK, Barclaycard was the first to adopt contactless technology in their credit cards in 2007. By December 2014, there were 58 million contactless cards in circulation in the country and 147,000 NFC terminals in use. The original maximum when contactless first came out, was £20. Now, because of its success and high usage, the limit has been increased to £100.

Contactless payments are perhaps what we are most familiar with today. With the question “are you contactless?” once a question we might have heard frequently, we now tend to assume that everywhere is contactless. Not just shops and restaurants, but car parking machines and vending machines that were once notoriously “cash only” and “no change can be given”. Even street buskers are now known to have contactless card readers.

Data from Barclaycard shows that 91.1% of eligible card transactions in 2021 were made using contactless, with the value of contactless payment made increasing by 40.2%, year-on-year. Individually, the average contactless user made 180 contactless payments in 2021.

Tap to pay

And contactless technology has not stopped there. Whilst we did just tap our cards, now we don’t even need to take a card with us. With contactless payment now being available on our phones and watches with Apple, Google and Android Pay, a lot of us now just leave our homes with our keys and phone. Not being able to buy something from a shop, or your round in the pub, because you’ve “got no cash” is a thing of the past. With no limit on ApplePay and a $2000 limit on GooglePay, you can pay for almost anything with just a flash of your phone.

It got us wondering, will there be a day that you just scan the barcode/QR code of something on your phone, pay instantly, and walk out(?!). The technology is already there and is being used in some stores, but you do still have to go to a “check out”. For example, Zara’s “self-checkout” tills, don’t need you to scan your purchases. You just throw them in the “basket”, all at once if you’re in a rush, and the entire basket acts as a scanner and will pick up every bar code it finds. Similarly, in Amazon Fresh stores, your shopping basket also just scans everything you throw in! This just means that maybe there isn’t going to be any need for check-out staff for much longer!